What is Forex?

Forex which stands for the foreign exchange market is the largest financial market in the world.

With its trade volume of $5.3 trillion daily, can you imagine how large the market is?

From the size of the trading volume, it’s obvious that there are a lot of traders and investors involved in the Forex market. You might be surprised that even in an economic crisis, Forex market can still remain profitable as currencies are always traded in pairs.

6 Primary Types of Forex Market

Have you ever tried to read a price chart before?

For those who did, you might notice that a chart is actually formed by Bollinger bands (a band plotted two standard deviations away from a simple moving average, which looks like lines) that are always moving up and down. These up and down movements help form different patterns.

So, how should we identify the types of charts from observing the movement of the lines?

When you see the lines are going uptrend, this is what we often call a bullish market. Bull shows that the economy is doing a great job.

On the other hand, when you see a downtrend, it’s called a bearish market. Bear reflects a bad economy.

Well, there are approximately up to 25 different market types. But as a beginner, we must first learn about these 6 primary types of market:

- Bull Normal

- Bull Volatile

- Bear Normal

- Bear Volatile

- Sideways Quiet

- Sideways Volatile

Let’s have a look at this price chart above.

We can see that the Sideways Quiet at the front of the chart are mostly formed by flat and light Bollinger bands.

On the contrary, a Sideways Volatile is formed by mostly flat but wider Bollinger bands.

When we compare a Bull Volatile and a Bear Volatile, we can see that they share the same pattern of nearly-vertical shaped and wide Bollinger bands.

The only difference between the two is the upward movement of a bull action and the downward movement of a bear action.

Same goes to the Bull Normal and the Bear Normal.

Both of them have a wide Bollinger bands, owing to the only difference of the upward leaning movement of the bull and the downward leaning movement of the bear.

It’s actually quite simple to identify if you just remember these:

Bull = Uptrend

Bear = Downtrend

Volatile = Sharp Movement of uptrend or downtrend

Normal = Continual & gradual movement of uptrend or downtrend

When To Trade Forex?

The Forex market can be broken up into mainly 3 trading sessions, which are the European session (London), American session (New York) and Asian session (Sydney & Tokyo).

The trading week starts with the Asian session at every Sunday, 22:00 GMT, and finishes at every Friday 22:00 GMT with the American Session.

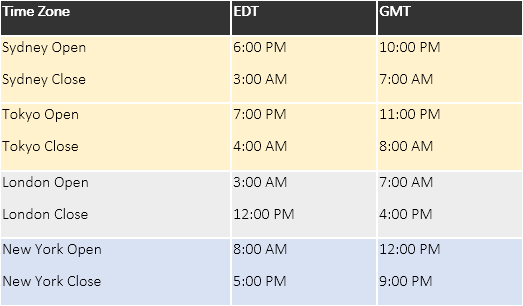

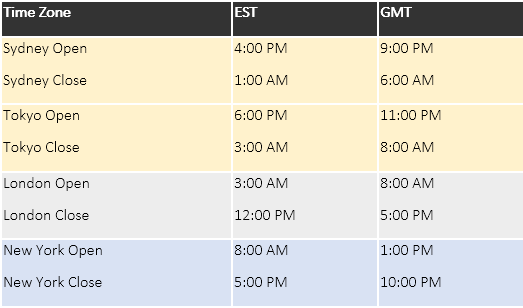

Below are tables of the open and close times for each session:

Summer (approx. April – October)

Winter (approx. October – April)

The actual open and close times are based on local business hours which might vary during the months of October and April as some countries shift to/from daylight savings time (DST). The day within each month that a country may shift to/from DST also varies.

You can see that there is a period of time where two different sessions are open at the same time. For example, during both summer and winter, from 8:00 am – 12:00 pm EST, the London session and the New York session overlap.

Naturally, these are the busiest times during the trading day because there is more volume when two markets are open at the same time.

How To Become A Forex Trader?

It is actually quite simple to start your journey as a Forex trader.

The only thing you’ll have to do is to look through the brokerage firms to find yourself a broker!

A Broker gives opportunity for small investors to initiate operations in the Forex market.

Beware of Scam Brokers!

Are You Aware Of The 11 Red Pointers That Warns A Suspicious Broker?

To become a client of a broker, you’ll need to open an account and make a deposit. The amount of deposit might vary from broker to broker.

In order to maximize their client’s profits, every company establishes certain credit level, also known as leverage. With the use of leverage, you may invest in a small amount to gain a higher return.

6 Reasons To Start Forex Trading

1. Work at Your Own Pace

Forex can be traded 24 hours a day and 5 days a week. It’s suitable for those who wish to trade on a part-time basis. You get to set your own trading schedule. Whether it’s to trade over breakfast, during your lunch break or before you sleep.

2. Start As Small As $25

If you think that you might need a ton of money to get started as a currency trader, well that’s not true! Online Forex brokers does offer “mini” and “micro” trading accounts, with a minimum of account deposit of $25. It’s a great offer for those who doesn’t have much trading capital to start-up with.

3. High Liquidity

Forex is the by far the most liquid market in the financial world. Without time limits and volume of trade, it is possible for you to make deals with the market at any time! There will always be a buyer or a seller when you wish to sell or buy a currency pair.

4. High Leverage

Leverage is a great tool provide by brokers, allowing you to invest in a small amount of money while trade it with a greater volume. With leverage, it is possible for you to maximize your profit from 50 to 200 times faster in a single trade.

But on the other hand, it also means that you might lose 50 to 200 times quicker!

5. No Commission Fee

You don’t have to worry about being charge with any types of fees, for examples clearing fees, government fees, exchanges fees etc. This is because most retail brokers are being compensated through something they called the “bid/ask spread”.

6. Easy to Learn

You don’t have to be a professional to trade! Forex trading can be easy to learn as there are a lot of websites and gurus out there willing to share their skills.

Open a free demo account to practice and enhance skills before you start throwing your own money in a live trading.